Mortgage Rates In 2025: What Homebuyers Need To Know

Why 2025 Is a Turning Point for Mortgage Rates

If you’ve been watching the housing market, you already know mortgage rates are a hot topic in 2025. After years of fluctuating costs, buyers are wondering: Will this year bring relief or more financial hurdles? Understanding how mortgage rates work, what’s influencing them now, and how to plan ahead could save you thousands over the life of a loan.

The Current State of Mortgage Rates

As of early 2025, the average 30-year fixed mortgage rate sits around 6.6%, while 15-year loans hover closer to 5.9%. These numbers reflect ongoing efforts by the Federal Reserve to balance inflation with economic growth.

- Why this matters: Even a 0.5% change can significantly alter monthly payments. For example, on a $300,000 loan, a half-point increase can cost nearly $100 more each month.

- What’s ahead: Analysts predict moderate stability in the second half of 2025, though global events and inflation trends could quickly shift the picture.

(📖 For deeper insights, check reliable resources like Freddie Mac’s Primary Mortgage Market Survey.)

Factors Influencing Mortgage Rates

Mortgage rates don’t rise or fall randomly. They respond to multiple economic levers:

- Inflation levels – Higher inflation generally pushes rates up.

- Federal Reserve policy – Rate cuts or hikes directly impact lending.

- Bond market performance – Mortgage rates often move in sync with the 10-year Treasury yield.

- Credit scores & personal finance health – Lenders adjust based on borrower risk.

Understanding these drivers gives buyers a roadmap for anticipating changes rather than reacting to them.

Comparing Loan Options in 2025

Not all mortgages are created equal. Choosing the right type depends on your timeline, finances, and risk tolerance.

| Loan Type | Average Rate (2025) | Best For | Key Considerations |

|---|---|---|---|

| Fixed-Rate Mortgage (30-Year) | ~6.6% | Long-term homeowners | Predictable payments, higher initial rates |

| Adjustable-Rate Mortgage (ARM) | ~5.9% (intro) | Buyers staying <7 years | Lower start, possible spikes later |

| FHA Loan | ~6.3% | First-time buyers | Easier approval, requires mortgage insurance |

| VA Loan | ~6.1% | Veterans & military | No down payment, limited to qualified borrowers |

| USDA Loan | ~6.2% | Rural buyers | Low rates, no down payment, area restrictions |

(Data compiled from lender surveys and Bankrate).

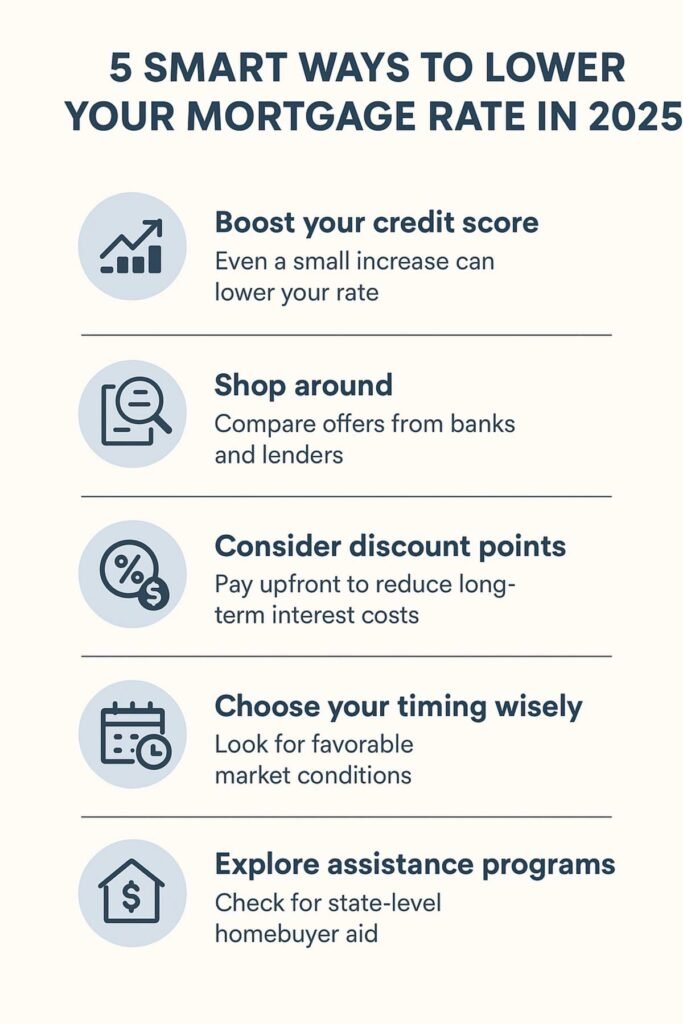

Smart Strategies for Securing the Best Rate

Even with higher averages, there are ways to land a better deal:

- Boost your credit score – Even a small increase can lower your rate category.

- Shop around – Compare offers from banks, credit unions, and online lenders.

- Consider discount points – Paying upfront can reduce long-term interest costs.

- Choose your timing wisely – Rates fluctuate weekly; locking at the right time matters.

- Explore assistance programs – State-level initiatives often help first-time buyers manage costs.

What This Means for Homebuyers in 2025

Buying a home in 2025 means adapting to a new reality. While rates are higher than in the ultra-low period of 2020–2021, they remain below historic highs. Homebuyers who focus on preparation, flexibility, and knowledge will be best positioned to succeed.

Key takeaway: Don’t just chase the lowest mortgage rate—consider the overall cost of ownership, loan type, and your personal timeline.

Turning Uncertainty Into Opportunity

Mortgage rates in 2025 may seem intimidating, but they don’t have to derail your homeownership goals. With smart planning, thorough research, and a clear understanding of market trends, you can secure a mortgage that works for your future.

👉 If you found this guide helpful, share it with a friend or check out our related post on Online Banking Apps 2025: 10 Best for Security & Savings

Anyone tried rajajoycasino? It looks pretty promising! The signup bonus is decent and the games are varied! Here is the link for you to check rajajoycasino

Okay, winchidoapp… a mobile app? Perfect for gaming on the go! Hope the interface is smooth and the game selection is top-notch. Downloading winchidoapp now to give it a spin!

Gotta love those lucky numbers! 777xk’s design is pretty sharp. Just hoping it translates to winning big time. Worth a peek, eh? Head over here: 777xk

Yo, mk7k’s got a decent selection. Been kicking around there for a bit. Nothing crazy, but solid for a casual spin now and then. Check it out at mk7k.

aajogos is pretty good. Lots of different games to try, so you won’t get bored easily. Check the games out at aajogos.

Alright betbet, let’s get betting! Hoping for some big wins this time. Time to risk it for the biscuit: betbet

Noobwingamedownload, eh? Sounds like a good place to grab some mobile games. Will give it a whirl and see if anything catches my eye. Explore the downloads here: noobwingamedownload

Looking for the latest hot games? 777xkgamedownload seems to have a good selection of fun games. Find the games here: 777xkgamedownload, maybe you’ll find something you like.

Been searching high and low for the 188bet apk. This site looks like it has a clean version. Giving it a shot now and sharing the link where you can get your 188bet apk.

Second time playing on iijogo and still enjoying it. The graphics are good and the gameplay is smooth. Give it a shot, you might like it. iijogo

Just cruised through blazer casino, y’know. Not bad! Nice layout, decent graphics. Might be a fun place to drop some cash. See for yourself: blazer casino