Mortgage Rates Plunge to 6-Month Low—What It Means for Buyers

Introduction: Why Falling Mortgage Rates Matter

Imagine scrolling the news and seeing: “Mortgage rates hit their lowest level in six months.”

For anyone planning to buy or refinance, that’s more than a headline—it’s a potential game-changer. With 30-year fixed home loan rates dipping to the mid-6% range, borrowers are wondering: Is now the moment to act, or should I wait for the Fed to cut rates further?

Let’s break down where borrowing costs stand, how Fed policy plays in, and what this shift really means for buyers today.

Where Mortgage Rates and Home Loan Rates Stand in 2025

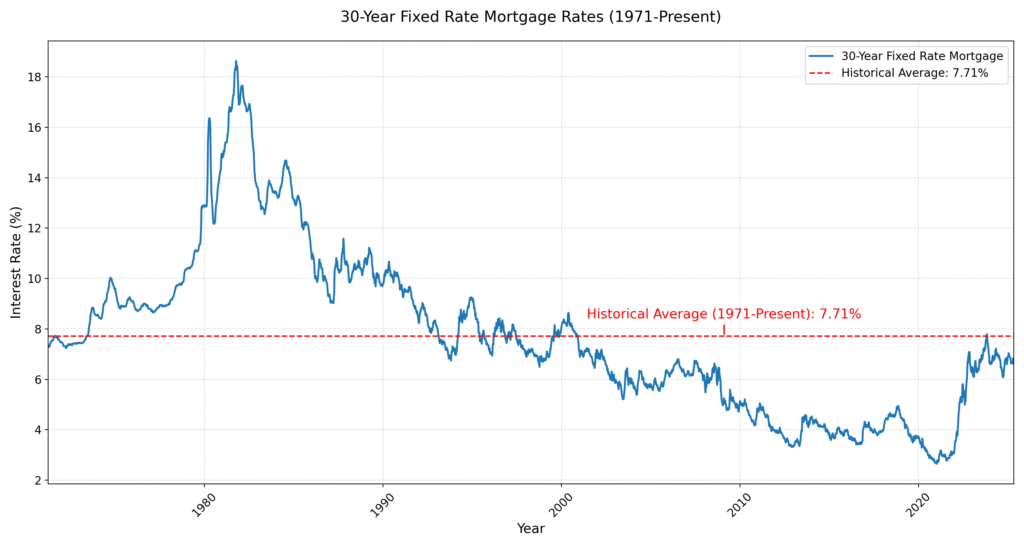

As of early September 2025, the average 30-year fixed mortgage rate dropped to about 6.46%, the lowest level in nearly a year. Just months ago, buyers were staring down rates above 7.5%.

Why the drop?

- Treasury yields have been falling, especially on the 10-year note that lenders use as a benchmark.

- Weaker job data in August sparked expectations of Fed rate cuts, easing yields further.

- Lenders often price in anticipated moves early, so mortgage interest rates adjust before official Fed action.

This small dip could save buyers hundreds of dollars monthly, making homes slightly more affordable in an otherwise challenging market.

How Fed Cuts Impact Mortgage Rates and Home Loan Costs

Short-Term vs. Long-Term Rates

It’s easy to assume that when the Federal Reserve cuts rates, mortgage costs should follow. But that’s not how it works:

- Fed rate cuts mostly affect short-term lending: credit cards, auto loans, and adjustable-rate mortgages.

- Long-term borrowing rates depend far more on the 10-year Treasury yield and investor expectations about inflation and growth.

That’s why in late 2024, housing loan costs actually climbed—even as the Fed made multiple cuts. Bond markets, not the Fed alone, drive the direction of home financing rates.

Why Home Loan Rates Are Falling Now

Several forces are at play:

- Weak job reports → signal slower growth → push bond yields lower.

- Market expectations → investors betting on Fed easing buy bonds, lowering yields.

- Lender behavior → mortgage lenders often move preemptively, adjusting rates ahead of Fed announcements.

Bottom line: Fed cuts may indirectly influence mortgage interest rates, but it’s the broader economic outlook and bond market that dictate the real numbers buyers see.

Key Insights: What Falling Mortgage Rates Mean for Buyers

Timing Isn’t Everything—But It Counts

A client of mine locked in at 6.5% last spring, worried rates would climb. Fast-forward to today’s 6.46%, and the difference—just 0.04%—still saves them thousands over a 30-year loan.

Even small dips in home loan rates add up. But waiting for perfection (like 5.5%) could mean missing opportunities entirely.

When Fed Cuts Backfire

Sometimes rate cuts can increase borrowing costs. How?

- Aggressive Fed easing may raise fears of inflation.

- Investors demand higher yields to offset risk.

- Higher yields push mortgage interest rates back up.

So while Fed cuts grab headlines, the bond market’s reaction matters more.

Lower Mortgage Rates Can Drive Up Home Prices

Here’s the trade-off: as borrowing costs drop, more buyers enter the market. That new demand often pushes home prices higher.

Economists estimate that for every 1% drop in housing loan costs, home prices can rise by 8–10%. So buyers might save on interest but face steeper listing prices.

Affordability Is More Than Just Rates

According to Redfin data, affordability only returns to “normal” when:

- Mortgage rates fall closer to 5.5%

- Home prices stop climbing rapidly

Even then, markets like San Francisco and New York may remain unaffordable without major supply changes.

Smart Moves for Homebuyers in a Changing Mortgage Rate Market

If you’re deciding whether to buy now or wait, here’s a practical playbook:

- Act if today’s numbers work for you. Don’t gamble on uncertain future cuts.

- Track key signals. Jobs reports, inflation data, and Fed announcements can move rates quickly.

- Shop around. Mortgage lenders often vary by 0.25% or more, even on the same day.

- Balance rate vs. price. Lower borrowing costs may trigger bidding wars—be ready to move fast.

- Plan for refinancing. You can always refinance if rates drop further, but you can’t lower a past rate.

Conclusion: Reading Between the Headlines

The recent dip in mortgage rates to a six-month low is welcome relief. But Fed rate cuts alone won’t guarantee cheaper borrowing. Bond markets, inflation expectations, and economic signals shape the real path of home financing rates.

For homebuyers, the lesson is clear: focus on what works for your budget now. If a mortgage today fits your finances, consider locking in—knowing you can always refinance later.

Your Move: What Will You Do?

- Thinking about buying soon? Share your plan—are you locking in or waiting?

- Want more insights? Explore our refinancing guide or read about housing affordability trends.

- Stay updated. Subscribe to our newsletter for mortgage rate alerts, Fed news, and smart homebuyer tips.

Your dream home may be closer than you think—the key is knowing when (and how) to make your move.

If you found this guide helpful, share it with a friend or check out our related post on

- Mortgage Rates In 2025: What Homebuyers Need To Know

- Company Investments: 10 Smart Strategies for Growth

Alright, cb777game is where it’s at! The graphics are sick and the gameplay is addictive. Def recommend giving it a shot. Peep it: cb777game

bong88bio – Yet another entry point to Bong88 world. Worth my test or not? Does this offer a decent experience? Any info is helpful! What do you think? Find out here: bong88bio

Yo, peeped 7wg. Looks kinda interesting. Maybe a new spot to try my luck? Anyone got any insider info? Check it out see what you think 7wg.

Downloaded the xbetapk.net app the other day. Super easy to use for placing bets on the go. Definitely worth a try if you’re into that: xbetapk

Okay, Kinh88vina is a bit of a deep dive. Definitely has its own vibe. I’d say it’s worth checking out if you’re into a more niche or localized experience. Might not be for everyone, but could be your cup of tea. See for yourself here kinh88vina

Downloaded the Playpix app the other day. Pretty smooth experience so far! Give it a whirl at: playpix app

Just tried vf555 and gotta say, I’m liking the variety of games they offer. Plus, the signup process was super quick and simple. Could use a few more promos, but overall a solid experience. Check out the action: vf555

Yohohobet, arrr, mateys! This one’s got a fun vibe. The interface is easy to navigate, and they seem to have a fair selection. Give it a go if you’re looking for something a bit different. Shiver me timbers: yohohobet

Just tried 777egame, and I’m digging the vibe. Easy to sign up, good game selection. Got a welcome bonus, which is always a plus. Maybe I’ll win big! Click to try: 777egame

Gave 84bet1 a go today. Navigation is simple, so easy to find what you’re looking for. A pretty good option if you wanna kill some time, hopefully with some good fortune too. Here’s the link: 84bet1

I checked out abjilicasino. Easy to navigate, a big plus for me. Loads fast on mobile, which is super important. Gave it a few spins and had a decent time! See for yourself: abjilicasino