10 Best Business Bank Accounts for Small Businesses in 2025

Running a small business in 2025 is more dynamic than ever—and choosing the right business bank account can be the difference between smooth financial management and unnecessary headaches. Whether you’re a startup founder, freelancer, or scaling entrepreneur, your bank account isn’t just where money sits—it’s a tool that shapes how you manage cash flow, expenses, and growth.

In this guide, we’ll break down the 10 best business bank accounts for small businesses in 2025, explain their unique features, and help you decide which one matches your business goals.

Why the Right Business Bank Account Matters

A business bank account offers more than just a place to deposit money. It:

- Separates personal and business finances (crucial for taxes and liability).

- Builds credibility with customers and vendors.

- Provides access to business-friendly tools (loans, merchant services, integrations).

- Simplifies bookkeeping and tax reporting.

Now, let’s dive into the best options available this year.

1. Chase Business Complete Banking

Best for: All-around small business banking

Chase remains a leader thanks to its nationwide presence and robust online banking. The Chase Business Complete Banking account offers:

- $15 monthly fee (waived with $2,000 minimum balance or qualifying transactions).

- Free online bill pay and mobile check deposits.

- Integrated credit card processing with Chase QuickAccept.

- Over 16,000 ATMs and 4,700 branches nationwide.

👉 Ideal for businesses wanting both digital convenience and physical branches.

2. Bank of America Business Advantage Fundamentals

Best for: Growing businesses needing flexibility

Bank of America offers tiered accounts designed for scaling businesses. Key benefits include:

- $16 monthly fee (waived with $5,000 average balance).

- Cash Flow Monitor tool for real-time expense tracking.

- Rewards with the Business Advantage Relationship program.

- 17,000+ ATMs nationwide.

Their seamless integration with accounting platforms makes it great for financial planning.

3. Wells Fargo Initiate Business Checking

Best for: Businesses prioritizing customer support

Wells Fargo combines digital banking with extensive branch support.

- $10 monthly fee (waived with $500 minimum balance).

- 100 free transactions per month.

- Extensive financing options, including SBA loans.

- Dedicated small business specialists.

This is a solid choice for entrepreneurs who value personalized guidance.

4. U.S. Bank Silver Business Checking

Best for: Fee-conscious small businesses

U.S. Bank’s Silver Business Checking has no monthly maintenance fee, making it one of the most affordable options.

- 125 free transactions per month.

- Online and mobile banking tools.

- Access to business lending solutions.

Great for startups and side hustlers looking to minimize overhead costs.

5. Capital One Spark Business Checking

Best for: Businesses that need unlimited transactions

Capital One is known for its straightforward pricing and flexibility.

- $15 monthly fee (waived with $2,000 balance).

- Unlimited free transactions.

- 70,000+ fee-free ATMs through Allpoint network.

- Strong digital banking features.

If you handle a high volume of transactions, this account stands out.

6. Bluevine Business Checking

Best for: High-yield business checking

Bluevine is an online-only bank offering one of the best APYs on a business bank account.

- No monthly fees.

- Earn up to 2.0% APY on balances up to $250,000.

- Unlimited transactions.

- Access to lines of credit.

This makes it perfect for businesses that want their money to work harder.

7. Novo Business Banking

Best for: Digital-first entrepreneurs

Novo is a fintech favorite for startups, freelancers, and e-commerce owners.

- No monthly fees.

- Integrations with Shopify, Stripe, QuickBooks, and PayPal.

- Free ACH transfers and mailed checks.

- Mobile-first design.

If you run a digital business, Novo’s integrations streamline your workflow.

8. Axos Business Interest Checking

Best for: Online-first small businesses

Axos offers an interest-bearing business account with digital convenience.

- No monthly fees (with average daily balance of $5,000).

- Earn up to 1.01% APY.

- Unlimited domestic ATM fee reimbursements.

- Remote check deposit.

Perfect for entrepreneurs who prefer fully online banking.

9. Mercury Business Banking

Best for: Startups and tech companies

Mercury caters to modern, fast-scaling startups.

- No monthly fees.

- Virtual and physical debit cards.

- API access for automating payments.

- Investor-friendly tools like venture debt partnerships.

Mercury’s modern features make it especially attractive to tech-driven businesses.

10. Relay Business Checking

Best for: Team-based expense management

Relay helps small businesses manage multi-user accounts.

- No monthly fees.

- Ability to issue up to 50 virtual or physical debit cards.

- Advanced budgeting and permissions for teams.

- Integrates with accounting platforms like QuickBooks and Xero.

A strong choice for businesses that need better control over team spending.

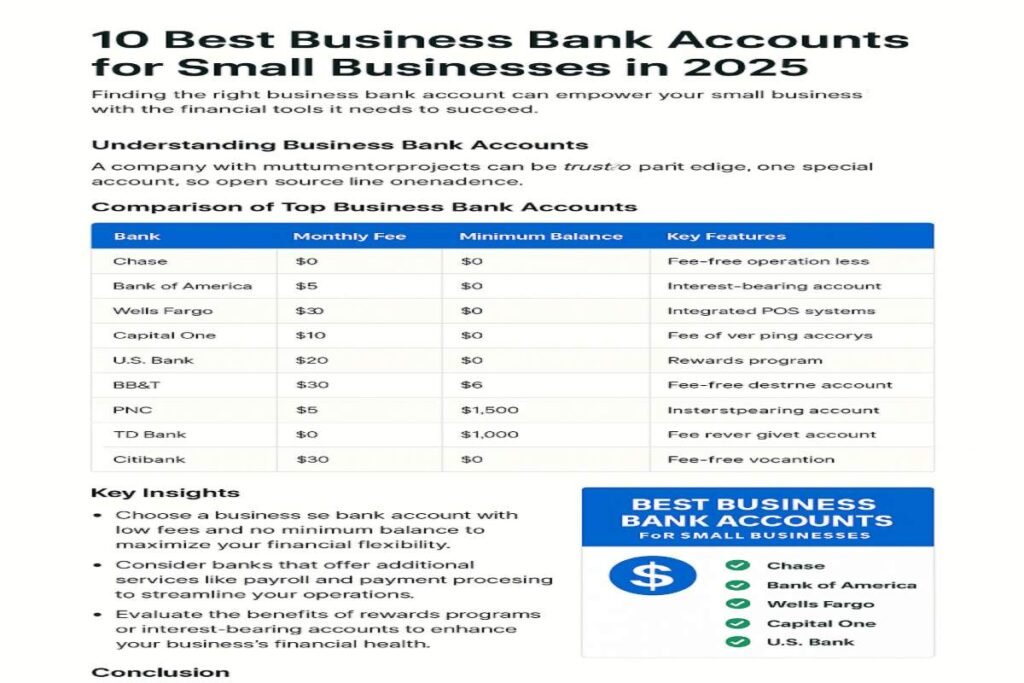

Quick Comparison Table

| Bank / Fintech | Monthly Fee | APY | Free Transactions | Best For |

|---|---|---|---|---|

| Chase | $15 (waived) | None | Unlimited digital | All-around banking |

| Bank of America | $16 (waived) | None | Unlimited digital | Growing businesses |

| Wells Fargo | $10 (waived) | None | 100 | Customer support |

| U.S. Bank | $0 | None | 125 | Low fees |

| Capital One | $15 (waived) | None | Unlimited | High volume businesses |

| Bluevine | $0 | Up to 2.0% | Unlimited | Earning interest |

| Novo | $0 | None | Unlimited | Digital entrepreneurs |

| Axos | $0 (waived) | 1.01% | Unlimited | Online-first |

| Mercury | $0 | None | Unlimited | Startups |

| Relay | $0 | None | Unlimited | Team expense control |

How to Choose the Best Business Bank Account for You

When choosing the right account, consider:

- Monthly fees: Can you meet the balance or transaction requirements to avoid them?

- Transaction limits: Will you exceed the free monthly transactions?

- APY earnings: Do you want your account balance to grow passively?

- Integrations: Does it connect with your business tools (QuickBooks, Shopify, Stripe)?

- Customer service: Do you need in-person support or prefer digital-only convenience?

Final Thoughts

Your business bank account is more than a financial tool—it’s a foundation for how you run and grow your company. From interest-earning accounts like Bluevine to integration-focused solutions like Novo and Relay, the best choice depends on your unique business needs.

If you’re just starting out, go for a no-fee option like U.S. Bank or Novo. If you’re scaling, Chase or Bank of America provide robust ecosystems. And if your business thrives online, Bluevine, Mercury, and Relay offer modern flexibility.

✅ Next Step: Review the options, compare your top 3 picks, and open the account that best aligns with your goals. A smart choice today sets your business up for smoother growth tomorrow.

👉 Have you tried any of these accounts? Share your experiences in the comments below—and check out our related guide on Online Banking Apps 2025: 10 Best for Security & Savings for even more financial tools.

Betting on my phone, that’s where it’s at! Is 11betmobile any good? Gotta be convenient. Check out 11betmobile if you’re on the go!

Before you jump in, peep the bettilttrreview first! Always smart to read the fine print and see what others are sayin’. Play smart, not hard, folks!

Downloaded the 8casinoapp the other day. It’s alright, graphics could be better, but the selection of games is decent. If you’re bored, give 8casinoapp a shot, but don’t expect too much.

Checked out Ktoaposta and it’s pretty good, specially if you like sports betting. Odds are good and the interface is nice! Give a try at ktoaposta.

Alright, so I stumbled upon wr777gamedownload. Looking to download some games? This might be the place Check it out, let me know what you find wr777gamedownload.