Best Balance Transfer Credit Cards 2025: 0% APR Deals

Introduction: Why Balance Transfer Credit Cards Still Matter in 2025

If you’re carrying high-interest debt, balance transfer credit cards could be your smartest financial move in 2025. With average interest rates above 20%, even a modest balance can spiral out of control. That’s why 0% APR introductory offers are so powerful—they give you breathing room to pay down debt without interest eating away at your progress.

But not all offers are created equal. Some cards come with longer 0% APR windows, others with lower transfer fees, and a few bundle rewards or perks that make them stand out. In this guide, we’ll break down the best balance transfer credit cards for 2025, what to watch out for, and how to choose the right one for your financial goals.

What Is a Balance Transfer Credit Card?

At its core, a balance transfer credit card allows you to move existing debt from one or more cards onto a new card—usually with a 0% APR offer for a set period. This means you can focus on paying off your balance without adding new interest charges.

Key features include:

- 0% Intro APR: Typically lasting 12 to 21 months.

- Transfer Fee: Usually 3–5% of the transferred amount.

- Post-Promo APR: The rate that kicks in after the intro period ends.

👉 Think of it as a “debt reset button”—but one you need to use wisely.

Best Balance Transfer Credit Cards in 2025

Below is a side-by-side comparison of some of the top picks available this year:

| Card Name | Intro APR Period | Balance Transfer Fee | Annual Fee | Standout Feature |

|---|---|---|---|---|

| Citi® Diamond Preferred | 21 months | 5% ($5 min) | $0 | One of the longest 0% APR offers |

| Wells Fargo Reflect® Card | Up to 21 months | 3% ($5 min) | $0 | Flexible intro extension |

| BankAmericard® Credit Card | 18 months | 3% ($10 min) | $0 | No penalty APR |

| Chase Slate Edge® | 18 months | 3% intro, then 5% | $0 | Chance to lower APR with good payment history |

| U.S. Bank Visa® Platinum | 20 months | 3% ($5 min) | $0 | Low post-intro APR compared to competitors |

(Data compiled from NerdWallet and Bankrate, September 2025.)

How to Choose the Right Balance Transfer Credit Card

When deciding, it’s not just about the longest 0% APR window. Ask yourself:

- What’s my debt payoff timeline?

If you can pay off your balance in 12–15 months, a card with a lower transfer fee may be better than one with 21 months of 0% APR. - How much debt am I transferring?

For larger balances, even a 1–2% difference in transfer fees can mean hundreds of dollars saved. - Do I want rewards too?

Some cards double as cashback or travel rewards cards—but be careful, rewards shouldn’t distract you from the main goal: debt repayment.

Personal Perspective: Why I Chose a Balance Transfer

A few years back, I was juggling about $7,500 in credit card debt across two cards with interest rates north of 19%. I signed up for a balance transfer card with 18 months of 0% APR.

Here’s what I learned:

- That breathing room allowed me to make steady payments without losing ground.

- The 3% transfer fee (about $225) felt steep at first—but compared to nearly $2,000 in annual interest, it was a bargain.

- Having just one monthly payment simplified my budget and reduced stress.

If you’ve ever felt like you’re on a treadmill of paying but never getting ahead, a balance transfer credit card can change the game.

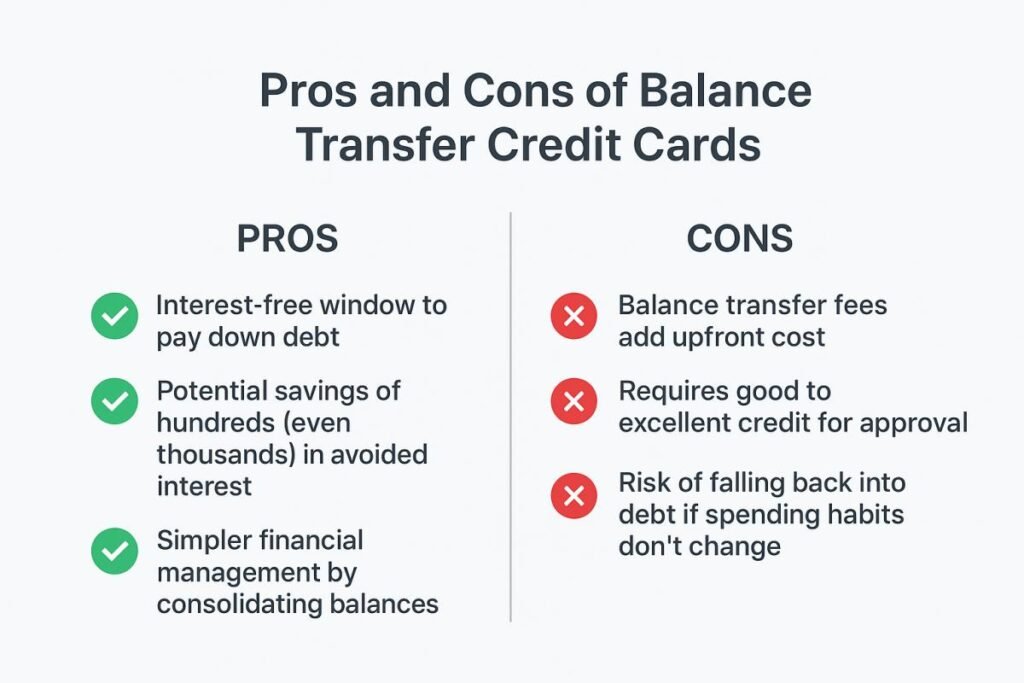

Pros and Cons of Balance Transfer Credit Cards

✅ Benefits

- Interest-free window to pay down debt

- Potential savings of hundreds (even thousands) in avoided interest

- Simpler financial management by consolidating balances

❌ Drawbacks

- Balance transfer fees add upfront cost

- Requires good to excellent credit for approval

- Risk of falling back into debt if spending habits don’t change

Smart Balance Transfer Credit Card Strategies

To make the most of your new card:

- Calculate before you transfer. Make sure savings outweigh fees.

- Commit to your timeline. Divide your balance by the number of 0% APR months to create a payoff plan.

- Avoid new purchases. Many cards apply payments to lower-interest balances first, leaving new purchases accruing interest.

- Pay on time—every time. One missed payment could cancel your 0% APR deal.

Are Balance Transfer Credit Cards Right for You?

A balance transfer credit card isn’t a magic fix. It works best if:

- You have a solid plan to pay off debt during the promo period.

- You qualify for the best offers (typically FICO 670+).

- You’re disciplined enough not to rack up new debt.

If that sounds like you, 2025 could be the year you finally tackle high-interest debt head-on.

Conclusion: Take Control of Debt in 2025

With credit card APRs at record highs, balance transfer credit cards remain one of the most effective tools for breaking free from debt. The right choice depends on your debt load, payoff timeline, and spending habits—but with smart planning, you could save thousands and achieve financial freedom faster.

💡 Take Action: Review your balances, run the numbers, and explore today’s top 0% APR offers. The sooner you start, the more you’ll save.

check out our related post on

Mortgage Rates Plunge to 6-Month Low—What It Means for Buyers

Best Digital Marketing Tools to Skyrocket Finance in 2025

Vnz66bet, I checked out Vnz66bet the other day because I was bored. Not bad! Things are pretty nice here. Here’s the link if you wanna give it your opinion too: vnz66bet

Guys, having trouble with logins can be a pain! But bj88dangnhap.org made life easy. The site is solid and super straightforward. Really saves time. Log in now: bj88dangnhap

I checked out 77jlactivity, it seems to be all about the promotions. If you are looking for free spins and bonuses then take a look!

Downloaded the app from 77jldownloadapp. Works on my android phone. Easy to download and use.

Tried using 77jlappdownload to download the app. It has a QR code that is easy scan.

Just signed up on okttlogin. The whole process was pretty smooth, no dramas. Fingers crossed its gonna be a good ‘un! Check it out bruv okttlogin.

Downloading the 939betapp. Hope it’s not a dodgy app. Fingers crossed for some smooth betting and easy wins! Download it from 939betapp.

ph44vip… hmmm, haven’t tried it myself yet, but my buddy swears by it. He says the VIP perks are legit. Might be worth a look if you’re a high roller: ph44vip