Nvidia Earnings Explosive Reveal: What Investors Must Know

Why Nvidia Earnings Matter More Than Ever

Every quarter, nvidia earnings reports spark conversations across Wall Street, Silicon Valley, and Reddit boards alike. With AI demand surging and chip shortages still lingering, this earnings call felt more like a milestone than a routine update.

In this article, I’ll unpack the numbers, share a few insights from watching NVDA chart in real-time, and lay out what the latest results mean for investors.

Breaking Down the Nvidia Earnings Results

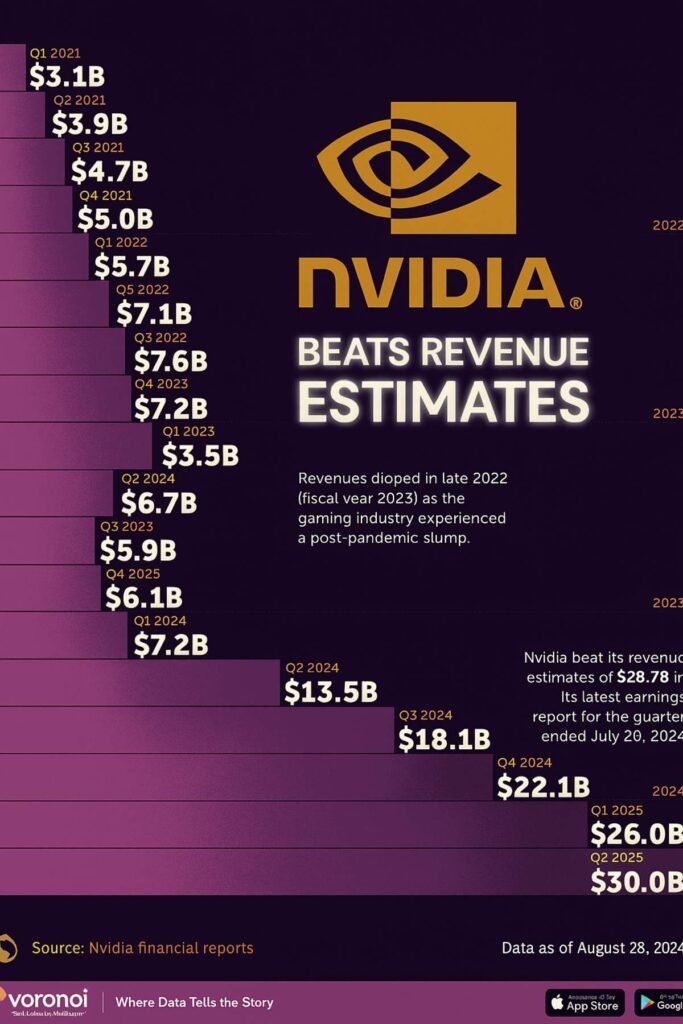

Nvidia reported Q2 fiscal 2026 revenue of $46.74 billion, an impressive 56% year-over-year spike, and a 59% jump in net income.(AP News) Earnings per share clocked in at $1.05, beating estimates hovering around $1.01.(Investors.com)

Yet, intriguingly, the stock slipped nearly 3–5% after-hours, largely due to data center revenues missing forecasted projections.(Reuters, Investors.com, New York Post)

Nvidia Stock Reaction—What’s the Market Saying?

Despite the earnings beat, after-hours trading turned sour.

| Metric | What Happened |

|---|---|

| Stock Movement | Slid 3–5% post-earnings |

| Investor Concerns | Data center revenue miss; uncertainties about China sales |

| Optimism | Strong guidance with Q3 revenue forecast hitting $54 billion(Reuters, AP News) |

Highlights from the Earnings Call

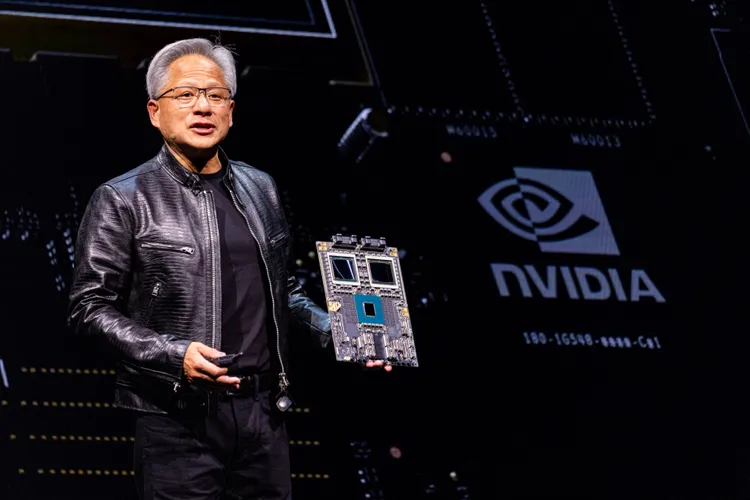

CEO Jensen Huang emphasized Nvidia’s long-term dominance in AI infrastructure, guided by demand for Blackwell GPUs and reasoning AI. He also noted delays in the H20 chip sales to China—but reaffirmed acceleration on the Blackwell ramp.(Investors.com, Reuters)

Does Nvidia Still Dominate AI? Investor Perspective

Absolutely—for now. As S&P Global’s Melissa Otto put it, “Nvidia is the bellwether for AI markets.”(Reuters)

That said, concerns about an AI bubble are brewing. Analysts caution the stock’s meteoric rise may not be fully justified if geopolitical headwinds or AI investment slowdowns persist.(AP News, The Guardian)

My Two Cents: Why This Nvidia Earnings Report Stood Out

- Confidence in AI demand—even amid macro risks, demand remains robust.

- China headache—H20 chip friction underscores fragility in key markets.

- Forward guidance matters—a $54B projection is bullish, yet miss-tones caused investor jitters.

Nvidia feels like a tetherball—not just dancing to earnings, but orbiting global macro forces. That’s both the beauty and the risk of being so central to AI’s growth story.

Nvidia Earnings—A Mixed Yet Powerful Signal

Nvidia’s earnings beat show AI demand is still surging—but caution remains over geopolitical risks, particularly in China. The $54B forecast suggests optimism, even if the stock wobbled after-hours.

For investors, it’s a dance between holding faith in AI’s runway and watching for signs of fatigue across global markets.

What Do You Think?

Is Nvidia still a long-term buy even after this mixed reaction? Or is it time to take gains? Share your take below—or click around for more:

- Is Taylor Swift Engaged? The Truth About Her Relationship Status

- Quarterly Taxes for Side Hustlers in 2025: Dates, Simple Math, 5-Min estimator

Let’s keep unpacking the future—together.

Easy peasy, Wolf777login went smoothly. No issues logging in, thank goodness! Hope the games are as easy. You can log in here: wolf777login

Alright guys, let’s take a quick look on bn555, seems interesting. Find it here bn555. Enjoy.

Nilfortuneonline… hmm, not too familiar with this one. Anyone know what it’s like? Safe to play there? Would appreciate the intel. nilfortuneonline

55666 bong88.net, huh? It’s got a certain charm, I’ll give it that. Maybe it’s your thing 55666 bong88.net.

Heard you’re looking for ‘sssgame 7’? Sssgames7.com should have what you need. Check it out and have some fun! Go to: sssgame 7